1st:“ Reviewing the financial results of the shipping majors in Japan for the year ending March 31, 2020 (PART 1)

- Financial results overview / Impact of new coronavirus / Raising fund”

Update:11th August 2020

Mr. Hirofumi Yamamoto /President, Japan Maritime Daily

Mr. Tsuyoshi Tanishige /President, MarineNet Co., Ltd.

This content sent as a live interview for MarineNet members only on June 9, 2020 are consists of two parts, the first part and the second part.

Tanishige:I would like to talk about the current state of the maritime industry while looking back at the financial results of three Japanese major carriers for the fiscal year ending March 2020 with Mr. Yamamoto, President of The Japan Maritime Daily.

As the main topics,

1)Financial results overview

2)Impact of new coronavirus

3)Raising Fund

4)Common Challenges

It is a touchy topic apart from the topic of these three companies, but I would like to talk about

5)The issue of reduction of charter rates requested by overseas operators>

(1) Financial result overview

Yamamoto:When I said that their financial results were in the black, some people were surprised at that in spite of the current painful situation. However I would like to point out that one year means period from April last year (not only now)

Tanishige:Three Japanese shipping majors, NYK, MOL, and K-Line successfully secured a surplus through ordinary income. Let’s see details.

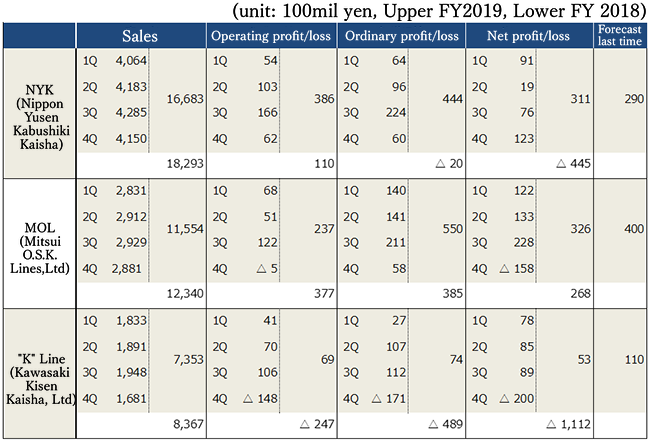

Final result of 3 shipping majors for year ended March 2020

Yamamoto:At first, there was a speculation that the current fiscal year would be a tough year.

What was good, the first point is the profitability of the ONE.

In the fiscal year ended March 31, 2019, they had a loss of 62.7 billion yen, and although the amount of the equity method reflected the deficit, they were able to issue net profit of 11.2 billion yen in the fiscal year ended March 31, 2020.

The second point is that the dry bulk market was generally as good as it did in the fiscal year ended March 31, 2019.

The Capsize rate averaged $17,000 per day and Panamax rate was about $11,000, which was slightly below the breakeven point.

Third point is the rise in the VLCC tanker market.

From the beginning of 2020, due to a significant decline in crude oil prices in the Middle East and a rise in crude oil supply capacity, there was strong inquiry for tankers as floating storage, and the price of spot chartering rate rose to a maximum of about $ 70,000 in January.

So to speak, the maximum instantaneous wind speed was the highest level ever.

The VLCC tankers owned by Japanese shipping majors, NYK and MOL were three each, but since the charter market has risen, there was a movement to sell VLCC tanker at the time of contract renewal at favorable conditions.

The fourth point is the improvement of the earnings of car carrier, which has been a problem for the three Japanese shipping majors in the past few years.

Crude oil prices were unstable, Middle East economies were not stable, purchasing capacity has fallen, so there were concerns about over supply of car carriers.

In addition, the three major shipping companies were struggling with high cost of shipping/trading of diversified products and small lots. Therefore, they began to review their service route. Besides that, exports to the Middle East had increased by about 4%, according to the Japan Automobile Manufacturers Association.

As a fifth point is bunker price. Although there were concerns that bunker prices would rise with the change to compliant fuel at the beginning of the year, they did not actually rise due to low oil prices.

Rather, it has become cheaper than the amount that three major shipping companies had procured earlier, so it was a situation where the valuation loss of inventory has come out.

Basically, I think that there is a point that the negative impact was small because the bunker cost seen conservatively became cheaper than expected.

Tanishige:With regard to car carrier earnings improvements, K-Line said that by the third quarter, the structural reform of car carriers segment had worked and contributed significantly to the whole result.

I was concerned about the effect of new coronavirus, but I have the impression that they managed to maintain in the fourth quarter, or that there was no serious loss compared to the anual forecast.

Ordinary income of MOL was 55 billion yen while the forecast was 50 billion yen, but overall net income was lower than expected.

As a factor, they recorded the provision for the Allowance for Doubtful Accounts of the affiliate company of the equity method, Gearbulk and the business loss of the container ship, so I feel that they got through it.

Yamamoto:The effect of new coronavirus appeared in the dry bulk market in March, and it was not surprising that the financial results were affected, market risk was hedged by Forward Freight Agreements (FFA), and the profit and loss of the actual voyage might not be recorded until the end of the voyage. Surprisingly, financial results showed that there was no actual impact of new coronavirus in March.

There was no comment that the influence of coronavirus came out greatly in the financial result briefing.

(2) Impacts of the new coronavirus

FY2020 consolidated financial forecast

Tanishige:Along with your forecasts for the current fiscal year, how do you see the impacts of new coronavirus, Yamamoto san?

Yamamoto:First of all, looking at the current fiscal year, important point might be financial condition, if you look at the cash flow for the fiscal year ending March 2020, NYK reports plenty of cashflow, 110 billion yen in operating cash flow, investment cash flow of 54 billion yen, and free cash flow is 62billion yen.

MOL has operating cash flow of 100 billion and investment cash flow is also about 100 billion. And Kawasaki Kisen's operating cash flow itself has become a deficit, so free cash flow seems to be severe because their deficit was more than 40 billion yen.

However, compared to the global financial crisis time, when cash flow was very severe, two of the three major companies started fiscal year 2020 in a situation where there was not that much damage to cash flow.

As for the influence of new coronavirus, car carrier is the most influenced sector in the impression that I interviewed three Japanese major shipping company since April, and this is common to the three companies.

The next influenced sector is container that is transporting general consumer goods, and the retained earnings is also kept in the surplus.

Dry bulk sector would follow that for transporting materials such as iron ore and coal.

Consumption would fall in the area of closest to the finished products.

The amount of crude steel transport in the first quarter was described as about halving.

With regard to car carriers and container ships, the number of voyages has decreased, and although the freight rate itself is said to be relatively good, the cargo movement itself is decreasing, so the first quarter may be severe.

Tanishige:The automotive industry expects Toyota's operating profit in the fiscal year ending March 2021 to decrease by about 80% compared to the previous fiscal year, however automobile production is expected to increase in China. Three Japanese shipping majors are gradually streamlining unprofitable service routes, and the amount of automobile transportation last year is about 3 million units. The issue might be how much fall. Some major companies expect transportation volume to decrease by about 50% in the first quarter, so it is expected to have a significant impact on the financial results. How long do you think it will last?

Yamamoto:At a Japanese shipping majors’ press conference, I found that automaker and steelmakers did not have a prospect. So, shipping companies could not make a prospect for transporting them.

With regard to material transportation, I think that the trade pattern will not change even after the convergence of new coronavirus, but when I listen to the financial result briefing, I feel that the future transportation pattern will change drastically for automobiles.

Tanishige:What trading pattern do you expect from shipping companies?

Yamamoto:As for the unprofitable car carriers’ services over the past few years, this is due to, for example, sending 6,000 units car carriers to small ports in South America. It is difficult to extend the service network around the world as it was in the past, considering cost of transportation. Under such difficult circumstance, new coronavirus has spread.

So, some person in charge of the shipping company says "good opportunities" to dispose of old ships.

It's hard to dispose car carriers for some reason because they could give them an image of a service decline to automaker, while some companies have clear policy of disposing of so-called old ships saying they can't provide good service.

The size of the car carrier fleet of shipping majors was about 90-100 vessels up to now, but I imagine that fleet size will be squeezed up to the core part of about 70-80 ships including the time chartered ship.

Tanishige:The unprofitable service routes that have been reviewed by the restructuring that they pursued last year will be further narrowed down in the future, aren't they?

It's an opportunity for a shipping company, isn't it?

Yamamoto:Yes.

For the three Japanese shipping majors, they want to maintain current services of transportation of major automakers because they are the pillars supporting companies’ profit.

However, some pointed out that the image of future for automobile industry is getting hard to see.

If you look at the trend of car carriers over the last few years, I have the impression that rather than expanding, they will go in the direction of re-examining other services while leaving a core part.

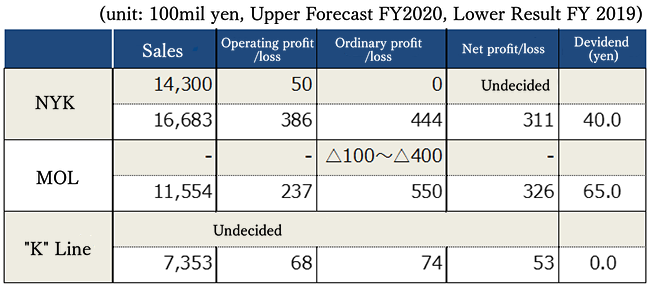

Tanishige:With regard to each company's earnings forecast for fiscal 2020, NYK has concrete figures of operating income and ordinary income, the net profit is undecided, MOL has a negative ordinary income of 100 to 40 billion yen, and K-Line is completely undecided.

(Note: MOL revised its current fiscal forecast upward to zero on June 17.)

Yamamoto:The ordinary income 0 issued by NYK is convincing.

While the IMF predicts economic growth of this year to be minus 3%, the pretax profit might be 50 billion to 60 billion yen in usual service speed, however after matching the minus 3% scenario to cargo volume in each sector, pretax profit might be down to negative from 50 billion yen to 60 billion yen, as a result, it would be zero profit.

If you look objectively at the dry bulk market conditions and the fall in car carriers, I get the impression that it is quite severe.

However, in interviews with three shipping majors, although some industries are forced to make major changes to consider entering different industries, but they also feel confidence that if coronavirus converges, they will be able to return to usual service speed.

Tanishige:I think it has come to be recognized around the world that maritime transportation is indispensable core infrastructure that support the global economy.

In terms of efficiency, they will undergo various changes, however shipping industry itself will not be lost, is it confidence in that sense?

(3) Raising Fund

Tanishige:In the financial result announcement, each company mentions credit line.

With regard to cash and deposits, K-Line accounted for 111.9 billion yen, and NYK had the lowest amount of 77 billion yen in cash and deposit balances.

MOL is 102.2 billion yen.

Yamamoto-san, as you said earlier, NYK and MOL post balanced free cash flows, while K-Line posts minus operating cash flow.

Yamamoto:Originally, shipping companies had accumulated cash and deposits since the global financial crisis, and K-Line was by far the larger between 200 billion and 300 billion.

NYK and MOL originally had a lot of cash and deposit balances, but there was pressure from investors that it would be better to have more liquidity, and management didn't have to have 200 billion yen in cash and deposits in ordinary time, so I have the impression that they have decreased cash strategically over the past few years.

With regard to credit line, NYK is 230 billion yen, MOL is 140 billion yen, and K-Line is 80 billion yen.

As the redemption deadline for corporate bonds will come this time, it is difficult for each company to issue corporate bonds, and the rating falls and attention has been being focused on the policy of each company.

NYK announced that they have secured 120 billion yen as a long-term loan for corporate bonds and commercial paper in addition to the 230 billion yen as a long-term loan.

K-Line also secured 80 billion yen as credit line and cashed them at 47.6 billion yen in April.

Each company has secured the money to prepare for contingency for the time being.

What I found interesting when I looked at NYK's financial results briefing was that at the time of the Lehman shock, the company's investment plan and new build vessel plan were scheduled to pay 1,130 billion yen, however in this new coronavirus disaster, it was 230 billion yen as of January of this year.

At the time of the Lehman shock, each company was pushed by a booming wave and excessive investment continued.

On the other hand, since this fiscal year was an event in the midst of structural reform, I think that the money they would spend in the future have to be controlled to some extent.

Companies have announced that credit line is also less than at the time of the Lehman shock.

Each company says that new coronavirus has a greater impact on maritime cargo movements than the Lehman shock, so I think shipping industry is different from other industries for such funding demand.

Tanishige:I see.

Each company does not have many newbuilding projects now and the demand for funds is different from the time of the global financial crisis.

Yamamoto:That's right.

After the Lehman shock, there was a situation where a large amount of money for the newbuildings that had to be paid immediately. When I was interviewing them at that time, there was a story that each company would borrow money as much as possible, and it was remarkable for me.

Compared to that, this time I have the impression that they are borrowing "normally".

Tanishige:The market is similar to those days when the shipping market in 2016 was significantly bad, not after the Lehman shock.

By the way, in the shipbuilding industry, new coronavirus has put on an additional bumb where orders for newbuildings are decreasing.

Yamamoto:Generally shipbuilders have to consider to get the order when the order book is shorter than two years, so now they are at just around the corner.

Unfortunately, due to the lack of newbuilding projects from shipping companies in Japan, they are negotiating with overseas operators considerably below the profitable level and Greek ship owners who have a track record of orders, and they seem to be working to make sure they get the order this summer.

For another theme

4) Common challenges, 5) The issue of reduction of charter rates requested by overseas operators will follow the second part of the 5th edition of "Talking deeply about seasonal topics" (To be published end of August)