2nd:“ Reviewing the financial results of the shipping majors in Japan for 1st quater / Aground accident at Mauritius”

Update:21st October 2020

Mr. Hirofumi Yamamoto /President, Japan Maritime Daily

Mr. Tsuyoshi Tanishige /President, MarineNet Co., Ltd.

(This content sent as a live conversation for MarineNet members only on 21st August 2020.)

【The grounding of the Capesize bulker WAKASHIO】

Tanishige:The main topic of today is the released financial result for the first quarter of fiscal 2020 for the three Japanese majors, however first of all, I'd like to talk a little bit about the accident in Mauritius. It has been reported in the general press every day, and is also covered daily in the Japan Maritime Daily articles provided by Marine Net. What do you think about this accident?

Yamamoto:Although there have been a lot of oil spill accidents in the past, I think that the last time an operator held a press conference was the case of NYK's crude oil tanker DIAMOND GRACE which ran aground and spilled oil at Nakanose in Tokyo Bay in 1997. I was invited to the press conference in the middle of holidays in August. There were two or three maritime journals, more than a dozen general newspapers and TV stations in attendance. This time at the press conference, I was impressed by the explanation that MOL was fully involved in the accident and that the company seemed to be in charge of everything including accident response. As a maritime journal, we have to carefully report about accidents because the news of marine accident is crossroads between maritime industry and general society, but when I wrote in my first report that MOL is the operator and that, in principle, the owner of the ship is responsible for the accident, the response to this first report was overwhelmingly positive, with 780 retweets of the article on Twitter. This kind of the content is common in the maritime industry, but this press conference gave me a sense of the heavy social responsibility of the major operators at the front of the public.

Tanishige:It is a typical case for us that local shipowners charter their vessels out to major operators as long-term time charter. For shipowners and operators, the case of an oil spill incident is to be assumed, and all procedures are provided to deal with such incidents. But in this case, I feel that because the ship ran aground on one of the world's largest coral reefs, the news coverage has been sensationalized. Shipowners and operators are in a so-called "business to business" world, where liability is defined clearly under contract. And shipowners contract any insurance preparing for any accidents like this case. That is our marine business, I think. However, I feel something wrong with that society start looking for the bad guys outside of business paradigm. I hope that people will understand that it is thanks to shipping industry that we are able to live our daily lives even in the midst of the COVID 19 outbreak.

Yamamoto:As a result of this accident, I asked other major operators whether their relationships with shipowners would change in the future. I expected that they would select shipowners from a safety management perspective, but they told me that they work together with the shipowners to ensure safety, for example by holding safety operation meetings.

It might not be good word, however, it is unexpected answer for me.

Tanishige:In the past, there have been cases where Japanese shipowners’ name were not disclosed and SPCs (Special Purpose Companies) were in the public to deal with accidents, however this time, MOL and Nagashiki Kisen Kaisha were quick to stand up and explain the situation to the public, which made me think that this is the way things are going to be in the future.

Yamamoto:I agree. From the beginning, Nagashiki Kisen Kaisha attended at the press conference and apologized, and I think this press conference will be a model case. As someone who listened to the press conference, I admit that when a vessel under time charter has an accident, it is necessary for the shipowner to at least explain the process of the accident in their own words against public.

Although not related to this accident, I was able to ask the shipowner that had been chartered to an overseas operator in the past about how the overseas operator had handled the accident. According to the shipowner, the overseas operator had only consigned the vessel to him under a charter party, so he assumed responsibility for the operation of the vessel and, on the basis of the contract itself, insisted that the shipowner should do something about it quickly. If this accident had occurred in Mauritius and the vessel was operated by a foreign operator, the Japanese owners would have been forced to take care of everything by themselves. Although the vessel is registered in Panama, the operator and owner are all Japanese, and the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) is deeply interested in the situation, which is a very good thing. Considering the fact that the number of Japanese shipowners' projects with overseas operators has increased significantly in the past few years, I felt that shipowners must be prepared to take the front seat in the event of an accident in the future.

【The announcement of the First quarter of fiscal 2020 results by three Japanese shipping majors】

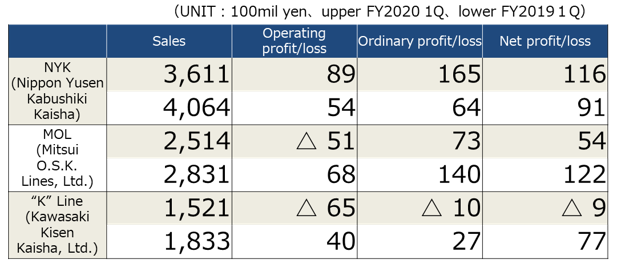

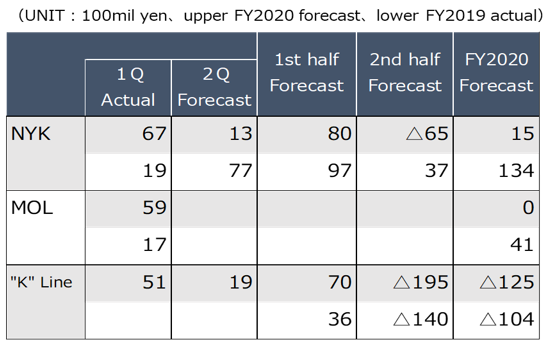

Tanishige:Even though under the environment of the new coronavirus pandemic, MOL secured a profit, and NYK's net income increased by about 30% compared to the same period last year. MOL's net income decreased by 55% and Kawasaki Kisen Kaisha posted a loss of ¥900 million. Nippon Yusen's increase is thought to be due to the 9.3 billion yen in ordinary income from Nippon Cargo Airlines (NCA), a subsidiary of NYK Line. How about your impression of these result?

Three Japanese Shipping majors’ consolidated result of 1st Quarter

Yamamoto:I'm surprised that these figures have come out even they had some reasons. When I interviewed the president of a major shipping company in March in the period that the new coronavirus was first detected, he predicted that the bottom fell out in April-June. Although there are differences in accounting methods such as the voyage completion standard, and about half of the car carriers were expected to be anchored and the containerships might be affected next. So they had secured the commitment line, however they actually turned a profit. While some companies in other industries, such as the automobile and steel industries, have posted losses of tens of billions of yen, NCA, NYK’s subsidiary was strong, and I think there are a several factors that contributed to its success, however, it's really wonderful that it was profitable. Kawasaki Kisen Kaisha Ltd. was forecasted to lose 4 billion yen in the media, however in fact it lost 900 million yen, and the two companies were able to achieve profitability at a time of stagnation of world economy. With regard to NYK Line, the term that reminds me is "marine transport" means "integrated logistics," which was often heard in the past.

Tanishige:Even though in the economic stagnation, international logistics continued to be operated, and they took steps to prevent the losses of the liner service by reducing the number of container vessels into operation.

Yamamoto:The number of car carriers, both in Japan and overseas, was halted for about half of the total number of vessels due to the stoppage or decrease of production by automobile manufacturers. Even though mooring container vessel to reduce their service still need cost, OCEAN NETWORK EXPRESS (ONE) posted an after-tax profit of $167 million in the April-June period alone. I think that's exactly the phrase "invisible industry" itself. I have heard that seafarers are considered to be the essential workers in the shipping industry, and that the situation was difficult because seafarers could not be replaced on the job site, however I feel that these essential workers have contributed greatly to the company's success.

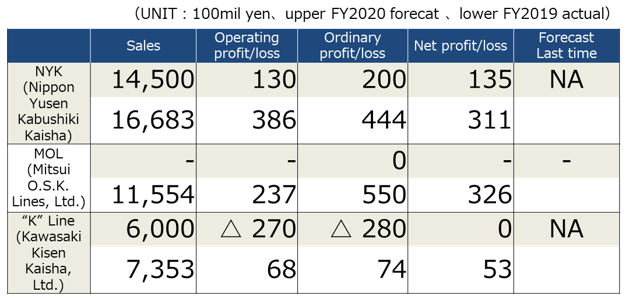

Tanishige:In terms of the outlook for the full year, there seems not to be changed so much in the outlook of the shipping sector of NYK, MOL. NYK Line is forecasting a net profit of 13.5 billion yen due to the positive impact of NCA, while MOL is forecasting no ordinary income, and Kawasaki Kisen Kaisha is forecasting a 28 billion yen ordinary loss and they intend to cover this loss by 20 billion profit of selling of their container terminal.

FY2020 consolidated financial forecast

Yamamoto:I think that's a very good explanation. Car carriers, which used to be the main segment of the three Japanese shipping majors, was impacted the most by the new coronavirus, but the fact that they were able to maintain break-even for the current fiscal year despite the complete collapse of that segment. It may be faster than their intended structural reform period, and I think that they should take this opportunity to carry out structural reforms and establish a structure that does not depends on car carriers.

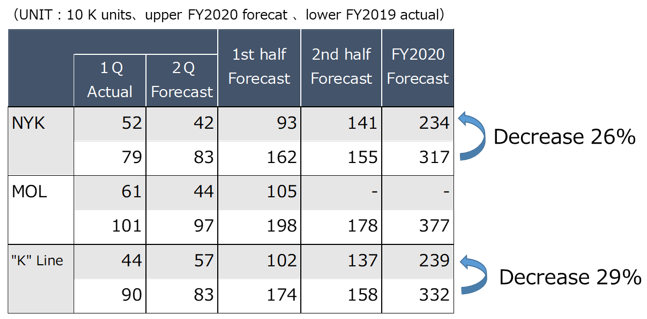

Tanishige:In terms of each segments, I think that the key to looking back at the financial results will be the car carriers, which have driven the shipping companies' financial results over the past few years, and the containerships, which have improved their earnings with the ONE. First, let's look at car carriers. NYK Line and MOL have different views on this sector. NYK Line expects a gradual improvement from the second quarter onward, while MOL is taking a pessimistic look at its full-year forecast, which calls for a 20-30% decline in car transport volume. Last year, MOL transported 3.77 million units. According to Toyota's announcement of financial result, they forecast a decline of almost 20% to 7.2 million units from 8.95 million units in terms of unit sales. NYK Line and Kawasaki Kisen Kaisha are also expected to be close to this figure, with a decline of 20-30%. I think they seem to be following Toyota’s forecast.

Car carriers

Yamamoto:The main reason why the three companies did not announce earnings forecasts at the beginning of the fiscal year was because they did not have production forecasts for automobile manufacturers. MOL is mainly focused on Nissan, while NYK Line and Kawasaki Kisen Kaisha are mainly focused on Toyota, so there are some differences among manufacturers. They are shifting from the traditional business model of sending large lots from Japan and Thailand to North America and Europe to the more frequent and small-lot transportation via South America and other regions. In the Middle East, the economy has slowed down due to falling oil prices, and profits have fallen due to lower transport demand, which has led to fleet rationalization. MOL has reduced its fleet from 107 vessels as of March this year to 95 vessels by March next year, and Kawasaki Kisen Kaisha has announced that it would reduce its fleet from 85 vessels to 71 vessels, a reduction of 14 vessels, or 10% of its original size. On the other hand, NYK Line will reduce the number of vessels by about four. This difference is caused by the way of maintenance of the fleet of each company. Kawasaki Kisen Kaisha has been deploying large vessels for the transport of railcars for Europe during the past several years consecutively, and MOL has been building a series of "FLEXIE" vessels for small-lot transport, however NYK Line has already took a break of fleet procurement and was not facing excess capacity even in the sudden decrease of cargo. I've heard stories from people involved. Each company is experiencing the same difficulties with car carriers, but my impression is that even though the overall volume of transport is decreasing due to fleet and service route rationalization, their profit structures are different.

Tanishige:Next, I would like to take a look at containerships. MOL did not announce a mid-year forecast, and NYK Line posted an increase of 1.5 billion yen in its full-year forecast. There is the major difference among them which is that Kawasaki Kisen Kaisha Ltd. posted a provision for loss on chartered vessels in the second half of the fiscal year, which resulted in a negative 19.5 billion yen and a negative 12.5 billion yen for the fiscal year.

Container Vessel

Yamamoto:I asked this question at the press conference, and it was due to a structural issue of the three companies about their containerships chartering out to ONE. NYK and MOL reported the future losses as an extraordinary loss quickly, on the other hand, Kawasaki Kisen has posted a provision for loss on chartered vessels in the second half of the fiscal year, and Kawasaki Kisen has stressed that it has already factored this in. Not only Kawasaki Kisen Kaisha, but other companies are a bit pessimistic about the containership business in the second half. However, containerships are high consumer vessel but bunkers price are far cheaper this year. Also, considering that containerships exporting semi-finished products and finished goods performed well in the April-June period when the impact of the new coronavirus was significant, I think the business will improve depending on ONE's performance, and there is some expectation that there may be an upward revision.

Tanishige:Both NYK and Kawasaki Kisen Kaisha have slumped in their second-quarter forecasts.

Yamamoto:I think they have taken into account the impact of the new coronavirus and the decline in global consumption such as apparel and materials. However, I think that there are possibility of upward revision if they continue to adjust of their container services.

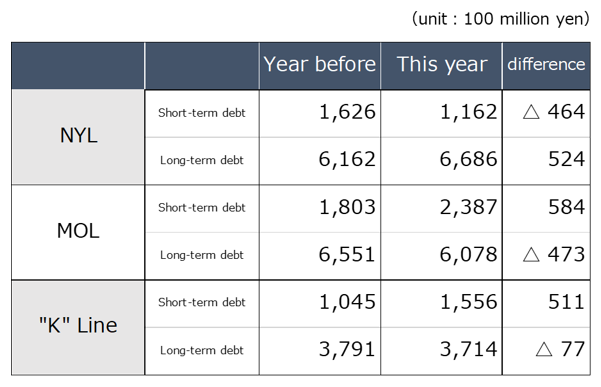

Tanishige:Now I'd like to talk about the balance between short-term and long-term debt in terms of finances. NYK Line has significantly reduced short-term debt and is raising long-term debt. On the other hand, MOL and Kawasaki Kisen have the opposite effect. MOL and Kawasaki Kisen have decreased their long-term debt and increased their short-term debt. I get the impression that there are three different ways to procure money. At MOL, as stated in their Rolling Plan 2020, they are reducing new investment cash flow to 100 billion yen over three years, which means that they are trying to increase free cash flow by restriction of new investment, in other words, saving money without spending it. This is an area that will be of interest for future fleet replenishment.

Debt Balance

Yamamoto:In the past, MOL has invested about 100 billion yen a year, so they are likely to cut investment considerably. MOL could consider using external capital, such as sharing expensive vessels, such as LNG carriers, as other companies have done. Furthermore, in contrast to the financial crisis and this time, the companies in common continue to reduce newbuilding orders due to the recession that began the year before. As announced by the shipyards, the amount of construction work on hand at Japanese shipyards is less than two years, one of the reason why Japanese shipping companies have not ordered newbuidings. Despite the limited order book at the shipyards, I think that the shipping companies are keen to further reduce new investment. However, as Tanishige san said, I'm not sure if this is enough to cover the replacements and other necessary vessels, because the companies operates with a fleet of 800 vessels.

Tanishige:If local shipowners get order newbuildings, Japanese operators’ cash flow will be improved.

Yamamoto:However, although the movement of cash by time charter is small from a financial point of view, I don't think there is an overemphasis on time charter. Because the companies know well that once they start to lose money on the PL due to deteriorating market conditions, it will affect their business base. If owners make the contract of charter with short period, they cannot borrow money from local banks, so it's difficult to find a way to combine them.

Tanishige:The current market is not very good at the moment. They say that the golden rule is to purchase vessels when the market is bad, and in that sense, I feel it is an opportunity.

Yamamoto:The three Japanese shipping majors are very sensitive to procure vessels since the financial crisis. They have a policy of "shippers first, cargo first", and therefore they do not order newbuilding vessels without cargo. It's like that part of the conflict between the administration and operation in the company. I think they are taking a very conservative view of the situation, given that there have been no orders for newbuildings or chartering projects at all. In fact, the number of vessels at the three major shipping majors is decreasing dramatically. The total number of vessels of these three majors used to exceed 2,000, with NYK Line and MOL having about 800 vessels and Kawasaki Kisen Kaisha Ltd. having about 500 vessels, but by the end of March, the number had fallen below 2,000 to a level of 1,800-1,900 vessels.

Tanishige:Does this mean that they are trying to improve the quality of their fleet rather than the size of it?

Yamamoto:My impression is that the general tramper, including Panamax and Handy, which have marketability, is rapidly shrinking, especially in the case of bulk carriers, which are returning vessels without extending charter period. This shows that they are taking market risks into account.

Tanishige:You're saying that they need to become healthier.

Yamamoto:That's exactly right. However, this trend toward to be healthier, fleet compression has been continuing for the past two or three years. In the past, 60% of Japanese shipowners’ projects financed by the local bank were for overseas charterers and 40% were for Japanese operators, but now all of the projects are for overseas operatorss. It's not because there is more business for overseas operators, but because there are no projects for Japanese operators.

I get the impression that the basic stance of the managements of Japanese operators, exception of minimal orders, is to focus on ESG, environmental and sustainability-focused vessels such as LNG-fueled vessels. I suppose they can expect to find themselves in a situation where they try to build up muscle, but before they know it, all they end up with is a bunch of bones.

Tanishige:I see that they've narrowed down the new investment segment significantly. We will continue to keep a close eye on their activities.

Thank you very much for your time today.

Yamamoto:Thank you very much.

To 1st (PART 2)

To 1st (PART 2)