3rd:“ Difficult situation of Japanese shipbuilding companies” (Part 1)

Reorganization of major shipbuilding companies and trends of each company:

"Alliance between Imabari Shipbuilding and JMU",

"Alliance between Mitsui E&S Shipbuilding and Tsuneishi Shipbuilding".

Update:9th December 2020

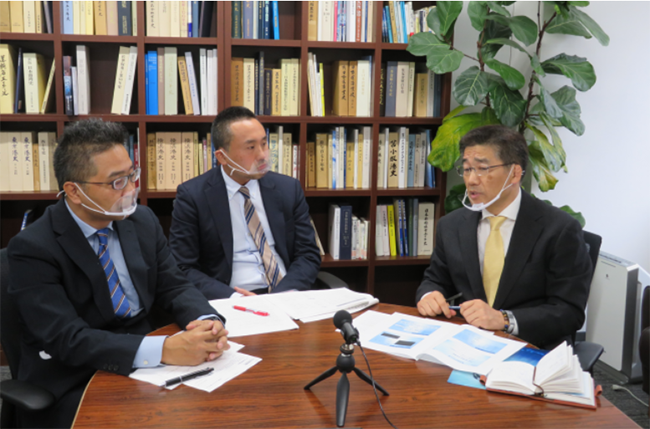

Mr. Hirofumi Yamamoto /President, Japan Maritime Daily

Mr. Yusuke Matsushita / Writer, Japan Maritime Daily

Mr. Tsuyoshi Tanishige /President, MarineNet Co., Ltd.

Tanishige:In the previous conversation, we discussed about the shipping industry and shipowners looking at financial results of Japanese shipping majors. I had many opportunities to negotiate with various shipbuilding companies during working in Marine Department of ITOCHU Corporation, and I am very much indebted to the shipbuilding industry, I have an affinity for it and I am still very much interested in it. Today, as usual, we have a conversation with Mr. Yamamoto, president of Japan Maritime Daily (JMD), joined by Mr. Matsushita, the writer from JMD.

Yamamoto:Up until now, we have talked about shipping, domestic shipowners and regional banks to members of the Marine Net website, but I have been hesitant to talk about the current situation at shipbuilding companies because it is difficult for me to discuss it during a live-streaming. However, today, I will talk about this topic as chief of the domestic shipowners reporting team with the help of Mr. Matsushita, the writer in charge of shipbuilding in this newspaper.

Matsushita:I have had the opportunity to interview various shipbuilding companies, and I would like to answer questions from Tanishige san to the best of my knowledge.

By the way, if there is anyone in the shipbuilding and shipping industries who is interested in rugby football, please do not hesitate to contact me (laughs).

* Mr. Matsushita is used to be rugby player.

Yamamoto:In other words, the three of us are sports-oriented (laughs), so I look forward to discussing with you.

Tanishige:Today we have over 200 viewers, so I am nervous but happy to be here. The main topics are

(1) Reorganization of major shipbuilding companies and trends of each company

(2) Trend of specialized shipbuilding companies

(3) Shipyard and market trends by type of Ships.

1) Reorganization of major shipbuilding companies and trends of each company

Tanishige:First, I would like to look at the financial summaries of each company for the last fiscal year ending March 2020 to get an image of the scale of each company. I have divided these shipbuilders into three categories: major shipbuilding companies, three listed companies, and specialized shipbuilding companies. If we list those major shipbuilding companies in order of revenue, Imabari Shipbuilding is the largest, followed by JMU, Mitsui E&S, Mitsubishi Shipbuilding, Kawasaki Heavy Industries, and Sumitomo Heavy Industries. The order of sales amount of the three listed companies is Namura Shipbuilding, Sanoyas Shipbuilding, and Naikai Zosen. Namura Shipbuilding, which we will discuss later, has a large sales volume due to their three shipyards, including Sasebo Heavy Industries and Hakodate Dock, if we compare it to other major shipbuilding companies, their sales amount is same level as those of Mitsui E & S.

For the sales amount of specialized shipbuilding companies, Oshima Shipbuilding appears to be doing well, while Tsuneishi Shipbuilding and Shin Kurushima Dockyard are at about the same scale of sales. In terms of operating profit and loss, unfortunately, Oshima is in the red.

Mitsubishi Shipbuilding, Naikai Zosen, and Shin Kurushima Dockyard are in the black, they are doing very well.

In addition, these three listed companies announced their financial results for the first quarter of the year, which unfortunately showed a loss. The forecast for the current fiscal year is also pessimistic. Looking at the financial results, I feel that the current situation, which is the theme of today's discussion ‘difficult situation of Japanese shipbuilding companies’, is illustrated well. As you may know, the shipbuilding companies’ financial results are suffering the current high cost of materials and other factors. This is because newbuildings that were ordered two to four years ago will be recorded as sales only at the time of delivery. If you look at their balance sheet, you can find that they are in a difficult situation where cash is decreasing. Though we see the situation about the middle size and larger shipyards this time, smaller shipyards are facing much difficult situation which is shorter cash. Because I have heard that the lack of orders has brought a negative impact where working capital is tight. As you know they receive the money from the buyer as a payment at the contract which they use as working capital. If they do not have orders, the shipyard may face shorter working capital than they expect.

Matsushita:Some shipbuilding companies have been doing well, Naikai Zosen has been building yen-denominated RORO vessels and ferries, and has managed to maintain a profit, but sales of unprofitable vessels that were ordered a while ago will start to be booked, and it has been said that their profitability would decline by some percentage from this fiscal year onward.

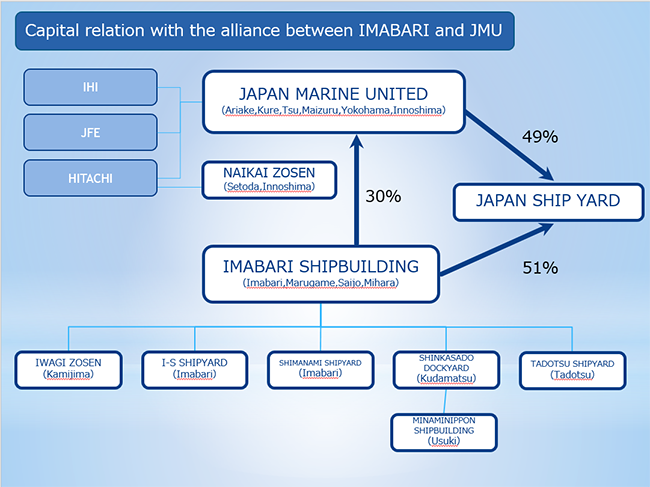

Tanishige:Having confirmed the scale of their business, let us look at the restructuring of the major shipbuilding companies while referring to the charts of the yards of each companies. The first one is the capital alliance between Imabari Shipbuilding and JMU. Imabari Shipbuilding will invest 30% in JMU, and they invest Nippon Shipyard (NSY), a joint venture company for merchant ship sales and design, with share of 49% by JMU, and 51% by Imabari Shipbuilding. As a result, they will create a huge shipbuilding group with JMU’s six shipyards, Imabari’s six yards and their four group shipbuilding companies.

What is the timeline for the establishment of this huge shipbuilding group?

Matsushita:Basically, we believe that preparations are progressing smoothly, and NSY will be launched early in the new year at the latest. When the alliance agreement was announced in March this year, we were expecting the establishment of the NSY by October 1, but this has been delayed twice due to the lack of approval from the competition authorities in Europe and China. And if the application has been "accepted", it is only a matter of time before the approval is granted.

Yamamoto:People tend to think that this establishment new group as if Imabari Shipbuilding and JMU will consolidate, but it is important to note that Imabari Shipbuilding will hold only 30% stake in JMU, and it is not a merger. Imabari Shipbuilding will not be equally responsible for their debts and other obligations but will participate as a major shareholder.

Matsushita:That's right. Each shipyard will have its own profitability obligation.

Tanishige:Will the shipyards be responsible for the working diagram/design of each shipyard?

Matsushita:At the joint press conference held in March, we could not get the details, but it was mentioned that the two companies will build ships jointly designed in the future. However, it will take about two years to get there, so I heard that they will start its operation by accommodating each other’s design drawings.

Tanishige:Along with JMU, Naikai Zosen is also partially owned by Hitachi Zosen. Isn’t Naikai Zosen expected to be part of this framework?

Matsushita:Currently, Naikai Zosen is not expected to participate, and I believe they will not participate in the future either. As the reason for this, when Imabari Shipbuilding and JMU announced their alliance in March this year, JMU received a 30 billion yen capital increase from IHI and JFE, their parent companies other than Hitachi Zosen, through a third-party allocation of new shares. As a result, IHI and JFE both hold 49.42% of the shares of JMU, and Hitachi Zosen's stake has been reduced from 8% to just 1.16%, giving the impression that they are fading out rather than getting involved in the new company. Hitachi Zosen has a 40% stake in Naikai Zosen, but I do not think that Hitachi Zosen will be the trigger for Naikai Zosen to form a partnership with NSY.

Tanishige:Naikai Zosen also builds coastal vessels, and I have the impression that its character is different from those of Imabari Shipbuilding and JMU.

NSY is a shipyard that builds a wide variety of vessel types, its product lineup is expected to be diverse. Do you know anything about what type of vessels they will focus on?

Matsushita:According to their announcement, they will build all vessels except for LNG carriers, but the tie-up between Imabari Shipbuilding and JMU will increase their share of the global market for Capesize, Panamax and other mid-sized bulkers.

And the immediate attention is payed to mega container vessel.

Although this has not yet been announced, OCEAN NETWORK EXPRESS (ONE), a company that integrates the container business of the three Japanese shipping majors, has been considering placing an order for 23,000 TEU's since around last year. Some say that this has been taking shape since before Corona. If negotiation resume, they will compete with shipyards in South Korea and China, however Imabari Shipbuilding and JMU have a track record of building nearly 30 mega container carriers, such as ONE's 14,000 TEU type ships, to date. Currently, ONE is operating vessels owned by the three Japanese shipping companies, but this will be ONE's first proprietary vessel, so I think it will be the type of vessel they will be focusing on most.

Tanishige:If the 23,000 TEU type container carrier is to be built, the capable building docks of both Imabari Shipbuilding and JMU under NSY, will be limited. Will Imabari Shipbuilding be the one to build the vessel?

Matsushita:They have not received any orders yet, but if they receive the order, I think JMU also will build mega container carriers.

Yamamoto:I have heard that Imabari Shipbuilding has been eager to build mega container carrierss since before the establishment of JSY. According to shipowners in Imabari and regional banks, ONE intends to order the vessels as their owned vessels through the government's JOIN (Overseas Infrastructure Fund, Overseas Transport and Urban Development Organization) fund. It is up to the operators’ decision, but there will also be vessels owned by shipowners, rather than having all of mega container carriers at their own.

Recently, according to a shipowner and a regional bank, there are almost no small and medium sized projects or only Chinese shipyard projects, and there are relatively more inquiries for large vessels such as mega container vessels and LNG carriers. Despite the limited number of projects, some shipowners are keen to own large vessels, and regional banks, which used to hesitate to have such projects due to the large amounts of money, seem to be looking at them positively these days. When I interviewed Iyo Bank the other day, they said that they would like to form a syndicated loan for large vessel projects. I get the impression that regional banks will shift their lending away from small- and medium-sized bulkers such as Panamax and Handymax to mega container vessels and LNG carriers with prices exceeding 10 billion yen, and I feel possibilities that these vessels may become mainstream for a while.

Tanishige:However, only a few shipowners will be able to do so, don't you think so?

Yamamoto:Yes, however I feel that there are some shipowners who are actively raising their hand.

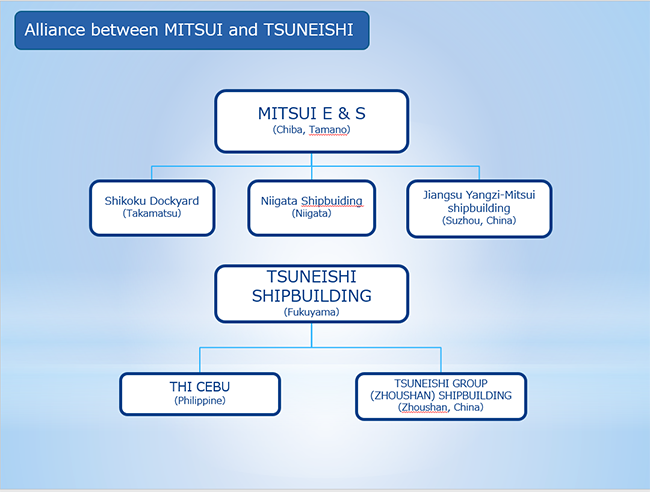

Tanishige:There is more to talk about NSY, however I would like to continue to look at others, the partnership between Mitsui E&S and Tsuneishi Shipbuilding. Mitsui E&S has a Chinese shipyard under called Jiangsu Yangtze Mitsui Engineering & Shipbuilding (YAMIC) as its subsidiary, and Tsuneishi Shipbuilding's construction yards are located in Cebu and Zhoushan in China in addition to the main yard in Fukuyama. Could you tell us the details of their situation?

Matsushita:There has been no official announcement in the details since their official announcement in July of this year that Mitsui E&S Holdings, the parent company of Mitsui E&S, would consider transferring part of its shares of Mitsui E&S to Tsuneishi Shipbuilding. As of July, however, Mitsui E&S Holdings indicated a timetable to finalize the details of the partnership by the end of this year and close the deal in October next year, and is believed to be proceeding in line with this goal.

At the time of the financial announcement in August, the president Oka talked about Mitsui's future orders for vessels to be built mainly by contractors with alliance, in addition to YAMIC. I think that the contractors refer to Tsuneishi Shipbuilding's head shipyard in Fukuyama, Cebu and Zhoushan. President Oka has made it clear that Mitsui E&S will be "fabless," that is, it will not have shipyards and will focus on engineering. In the future, I think that they will sell design drawings to shipbuilding companies other than Tsuneishi Shipbuilding.

Tanishige:Both companies have supplied the market with bulkers such as Ultramax and other bulkers, so I have the impression that they are going to promote sales in these design fields, however I think it will be essential for shipbuilding companies to focus on environmentally-friendly vessels such as next-generation fuels and new technologies, and it will be interesting to see how Mitsui E&S responds to these areas with its technological capabilities.

Yamamoto:YAMIC was established in August last year as a joint venture between China's privately owned Yangtze River Shipping, Mitsui E&S and Mitsui & Co. At that time, I felt that some Japanese shipbuilding companies, shipowners, and trading companies were opposed to the acquisition of a Chinese shipbuilding company by a Japanese trading company. On the other hand, I have the impression that many shipowners are interested in YAMIC these days.

Tanishige:One of the Japanese trading company's missions is to sell the ships built by Japanese shipyards to both Japanese shipowners and foreigners, so I imagine that they must feel dilemma when they decided to invest in a Chinese shipyard, however it might be clear that shipowners would like to secure competitive vessels, and I think they responded to their needs.

Yamamoto:I agree with you. Chinese shipyards are categorized into three patterns: (1) so-called "Japanese" shipyards such as Tsuneishi Shipbuilding's Zhoushan and Kawasaki Heavy Industries' NACKS and DACKS (Nantong Zhongyuan Kawasaki Ship Engineering and Engineering and Dalian Zhongyuan Kawasaki Ship Engineering, respectively) which will be discussed later, (2) state-owned shipyards such as Shanghai Waigaoqiao Shipbuilding, and (3) privately owned shipyards. I feel that there are many aspects of YAMIC that are unclear, such as whether it can be considered as a Japanese company, and whether it will be exclusively brokered by Mitsui or by other trading companies, however some shipowners consider it as a Japanese company because Mitsui E&S has a stake, while others do not. Obviously, the reaction of Japanese shipyards will be difficult, but the choice to invest in a Chinese shipyard is indeed an epochal event, and I feel that it is getting more and more appreciated in recent years.

Japanese ship operators, especially the major ones, want Japanese shipbuilding companies to continue to support the future of Japanese shipping industry. On the other hand, from the shipowner's point of view, it is difficult to offer competitive charter rates with vessels which were built in Japan due to the gap of the prices between Japan and China, and Chinese shipyards in which Japanese shipbuilding companies invest are considered to have brand power. So, it might be very difficult to evaluate them.

Tanishige:That's true. I think it is important to evaluate whether the shipyard in China have high quality operational systems. I am not sure about the status of the shipyard, as I have never visited YAMIC, however if the shipyard is competitive not only because of its investor but also because it utilizes Japanese technology and management, it would be getting a good reputation. In this respect, I think NACKS and DACKS are very good shipyards with Japanese blood flowing in it.

Matsushita:In this respect, NACKS/DACKS, Zhoushan of Tsuneishi Shipbuilding, and YAMIC are very different. 25 years ago, NACKS was started from zero by COSCO (China Ocean Shipping Group) and Kawasaki Heavy Industries, which transplanted the Sakaide factory's production system to the current one. (DACKS: in 2007, the company was established as Dalian Zhongyuan Shipbuilding Industry Co. In 2012, it changed company name to DACKS with raising rate of stake of KHI)

On the other hand, Tsuneishi Shipbuilding's Zhoushan is wholly owned by Tsuneishi Shipbuilding and it is a Japanese shipbuilding company, while the factory of YAMIC was originally a Taizong factory of China's privately owned Yangtze River Shipbuilding Industry, so it is an objective fact that the three companies have different characteristics.

Tanishige:Tsuneishi Shipbuilding's Zhoushan plant is regarded as Japanese shipyard, so they can only build vessels up to Kamsamax size due to some restrictions; NACKS and DACKS also have unique characteristics that they are partly Chinese-owbed companies and thus can build large sized ships.

To be continued to Part 2.

Of the topics on the Reorganization of major shipbuilding companies and trends of each company, following themes will be posted on Part 2 (Mid December)

1) Reorganization of major shipbuilding companies and trends of each company’, other subject on "Mitsubishi Heavy Industries-Oshima Shipyard" and

"To be independent? Sumitomo Heavy Industries and Kawasaki Heavy Industries,

2) Trends of specialized shipbuilding companies

3) Shipyards and market trends for each type of Ships.

To 2nd

To 2nd