3rd:“ Difficult situation of Japanese shipbuilding companies” (Part 2)

-Reorganization of major shipbuilding companies and trends of each company:

・MITSUBIHI HEAVY INDUSRIES & OSHIMA SHIPBUILDING/Isolationism?

・Sumitomo Heavy Industries・Kawasaki Heavy Industries

-Trends in specialized companies for shipbuilding

-Shipbuilding companies with their building vessel type

Update:6th January 2021

Mr. Hirofumi Yamamoto /President, Japan Maritime Daily

Mr. Yusuke Matsushita / Writer, Japan Maritime Daily

Mr. Tsuyoshi Tanishige /President, MarineNet Co., Ltd.

(1) Reorganization of major shipbuilding companies and trends of each company (Continued from Part 1)

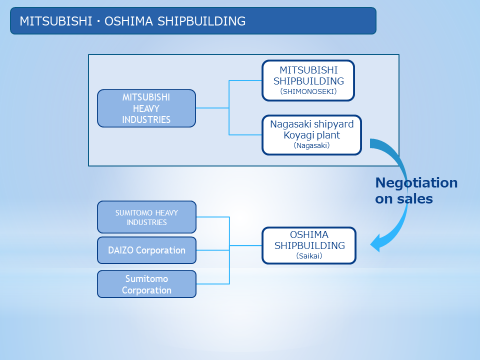

Tanishige:I would like to talk about the negotiation of the sale of the Koyagi Works of Mitsubishi Shipbuilding to Oshima Shipbuilding first. Oshima Shipbuilding is known as a specialized and middle class company for shipbuilding, however I pick this topic up as one included in the theme of reorganization of major shipbuilders. Although it has not been reported yet, if Oshima Shipbuilding were to hold the Koyagi Works, would it be mass-produce bulk carriers using the tandem method like Oshima factory in its 990-meter-long newbuilding dock?

Matsushita:Officially, there has been no further news since December 2019, when Mitsubishi Heavy Industries announced that it would start considering the sale of the Nagasaki Shipyard's Koyagi Works to Oshima Shipbuilding. At MHI's quarterly financial announcement, the general press is also interested and asks questions, however the only comment was that the negotiations were proceeding smoothly. The original plan was to reach an agreement by the end of March this year, however it seems to have been delayed due to the impact of the new Coronavirus from January. There is another repair yard at the behind of the new building yard in the Koyagi Works, and it had been under consideration to sell only the new building yard to Oshima Shipbuilding, however due to the new corona, Oshima Shipbuilding has been taking a longer time more than expected to conduct a site survey, and a cruise ship docked at the repair yard for a while, causing a pandemic of the new coronavirus. In this June, Oshima Shipbuilding's CEO, Shou Minami, resigned from his post due to old age, and some people in the industry said that the project itself would be abandoned because it was decided during his tenure. Mr. Tanishige mentioned the construction dock at Koyagi, which is said to be one of the largest in Japan, and where Mitsubishi Shipbuilding has been building five LNG carriers a year. However some people have doubts about acquiring a yard in a difficult situation of shipbuilding market. There has been no comment from the company on this point, however it is said that they will probably not mass-produce bulkers at the Koyagi Works, however build ammonia-fueled vessels and other vessels that require longer outfitting periods to meet new technologies, while maintaining continuous bulk carrier construction at the Oshima Shipbuilding.

Tanishige:It might be difficult to get the detailed information, if they acquire the facilities of the Koyagi Works, how will they manage the design team and manpower since there are people working in the Works? As for new technology, is there any possibility of a design alliance between the two companies?

Matsushita:So far, their policy on design has not been clarified.

Tanishige:In Kyushu, besides Oshima Shipbuilding, there are also the Namura Shipbuilding Group and MINAMINIPPON SHIPBUILDING which is one of the Imabari Shipbuilding Group, and I have the impression that they are less visible than those in the Setouchi region, however I would like to pay attention to them.

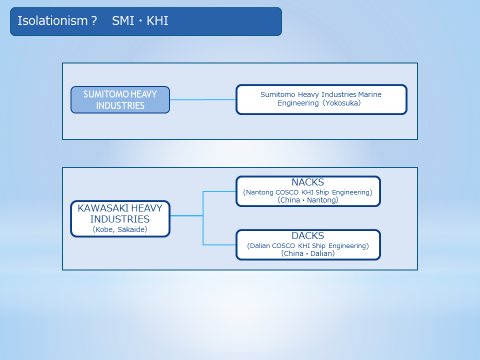

Next, we would like to discuss about the major heavy industries with whom there may be no tie-ups. In the grouping of shipyards, there is a distinction between shipbuilding companies with overseas operations and those with domestic operations only. First of all, Sumitomo Heavy Industries Marine Engineering, which spun off its shipbuilding division from Sumitomo Heavy Industries, builds mainly Aframaxes at its Yokosuka Shipyard. I have heard that repairs for the U.S. military also support the company's financial results, however for newbuilding operation, the company specializes in Aframax tankers. And Kawasaki Heavy Indutries (KHI), which has been mentioned earlier, how do you see it?

Yamamoto:As for KHI, for major operators, Building LNG carrier is their main category. Japanese operators used to decide the shipyard for newbuild LNG carriers by the tender. However, for the past five years or so, shippers have bid separately for operators and shipyards, particularly in the case of Middle East projects. This is the "arranged bidding" method. This has made the system more favorable to shippers.

In such a situation, Mitsubishi Shipbuilding Corporation has already withdrawn from the market for LNG carriers, on the other side major Japanese operators do not want to collapse Japanese LNG business.

And we have heard that a Japanese operator is strongly advocating to build LNG carriers with KHI, however it seems to be difficult. In the past, LNG carriers were built with project financing because they were high value-added vessels. In recent years, competition among LNG suppliers, such as Qatar and the United States, has become so fierce that there is a strong demand for competitive freight rates and for newbuild vessels to be priced at even one yen lower than their competitors.

Matsushita:Recently, Korean shipbuilding giants have made a large share of the LNG carrier market, making it difficult for the Sakaide works of KHI to compete alone. However, we have heard that KHI is planning to build its first LNG carriers in Sakaide and then build them at DACKS in China. Although the volume of building may not be as large as those in Korea, KHI believes that it will not lose out to Korea's cost competitiveness if it builds LNG carriers at DACKS because it can handle large orders.

Tanishige:That's an interesting story. We will have to keep attention to the future developments.

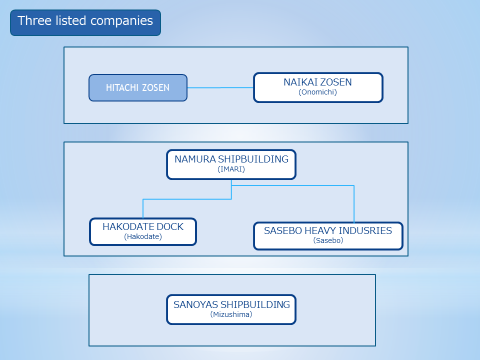

(2) Trends in specialized companies for shipbuilding

Tanishige:As a listed company, we can see their financial results of these three companies. NAMURA SHIPBUILDING operates Hakodate Dock and Sasebo Heavy Industries as its subsidiary companies, with operations in the north and south. Hakodate Dock builds small handy bulkers only, however ship-repairing has supported Hakodate Dock's business since the Meiji era, when it was the military hub of the north. I think Sasebo Heavy Industries also has repairing business, however I have the impression that they are struggling. I would like to keep attention on NAMURA SHIPBUILDING's management with regard to its product lineup and future direction.

Yamamoto:I heard that NAMURA SHIPBUILDING's main fields of business were Capesize, other large bulkers and VLCCs, and that the company was planning to increase profitability by continuously building 180,000 Dwt vessels, which were its strong points. Since the number of shipyards that can build such large bulkers are limited to NSY and others, Japanese concerned parties are hoping that the shipyard will remain as a competitive one. In fact, some shipowners are considering placing orders with NAMURA SHIPBUILDING, and regional banks are willing to finance to Japanese shipyards, however in many cases, operators who charter vessels are not yet decided.

Tanishige:Next topic is Sanoyas Shipbuilding. What is unique about Sanoyas Shipbuilding is that, along with shipbuilding, they have gas tank building business and leisure businesses as its second core called M&T (Machinery and Technology) business. Looking at the announcement of its financial results, the ratio of M&T business is increasing, which can be said to be due to the decrease in shipbuilding business.

Matsushita:Yes, shipbuilding accounts for 60% of its sales, and the onshore M&T business accounts for 40%. Instead, they said that the way of life for Sanoyas Shipbuilding is to maintain a balance between the two businesses. In shipbuilding, Sanoyas is engaged in the Kamsarmax building, however there were no orders in the April-June period of this year, and there are no publicly announced orders for this fiscal year either, however I have heard from a source that the company is working on a new Kamsarmax project.

(Note: On November 9, Sanoyas Holdings announced that it would transfer all of its shares in Sanoyas Shipbuilding to Shin Kurushima Dockyard by the end of next February. The company is trying to survive in the M&T business by transferring its inherited shipbuilding business.)

Tanishige:Its two strongest types are Kamsarmax and Ultramax. I think it is bit tough because it has to compete in the market. We would like to discuss the main vessel types of each shipyard later.

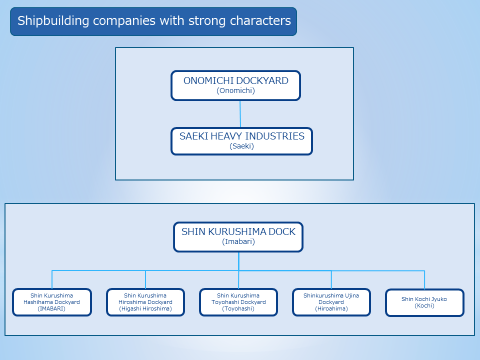

For the next topic, I pick up Onomichi Dockyard and Shin Kurushima Dockyard as shipbuilding companies with strong characters. Onomichi Dockyard has Saeki Heavy Industries as its subsidiary, however its distinctive feature is that the president Nakabe is leading the company as a shipyard specializing in MR-type vessel. Shin Kurushima Dockyard specializes in car carriers and chemical carriers, and is also involved in LNG fueled vessels, however building car carriers is influenced by the future trend of automobile industry. As for chemical carriers, there are no other major shipyards building chemical carriers in Japan. As I mentioned at the beginning of this session, the company's financial results have been strong, and they manage many of its yards well, and we hope that the companies will continue to do well.

Yamamoto:NYK Line has said that it would switch 40 car carriers to LNG-fueled vessels in the future, so demand would be expected to increase by about five or six vessels every year. Shin Kurushima Dockyard is the first company to place an order.

Matsushita:Shin Kurushima Dockyard has already received an order for a second LNG-fueled car carrier for NYK in January this year, and it is expected to follow its order.

Yamamoto:NYK's off-balance policy has enticed shipowners demands to own LNG-fueled car carriers, however the problem is ship management: there is a shortage of seafarers who can handle LNG fuel. Shipowners are looking for seafarers with experience or training in LNG fueled vessesl, mainly from foreign ship management companies and expensive cost is also problem. As for Onomichi Dockyard, we are also paying attention to President Nakabe’s message that Japanese shipyards will face a crisis if the current situation remains unchanged, and that they should find a way for Japanese shipyards to survive by utilizing of new technologies.

Matsushita:Yes, I have the impression that President Nakabe has a strong character (laughs). 5 or 6 years ago, while scrubbers and low-sulfur fuel were being discussed as alternatives to the SOx (sulfur oxides) regulations that came into effect earlier this year, Onomichi Dockyard consistently proposed MGO (marine gas oil) fuel. The company has completed the design of its main products 41,000 Dwt bulk carrier with Japan Engine Co. They have also been working on the detailed design of the MR model as well, and have had concrete discussions, but it seems to have been pushed back somewhat due to the new Coronavirus.

Recently, a near sea operator who would like to build an environmentally friendly vessel with new technology has taken an interest in the development of a 17,500 Dwt MGO fueled twin-decker (double-decker cargo ship), and I heard that the basic design was almost complete.

Tanishige:I am looking forward to talking next topic as last one. I have made list of shipbuilding companies with their building vessel type from the viewpoint of which shipyards would raise their hands if we invite offer now, based on my personal knowledge. I have not taken into account past construction results. Looking at DRY, I am reminded that Japanese shipyards are good at building dry bulkers. I understand for the capsize three companies, NSY, NAMURA SHIPBUILDING and NACKS. Kamsarmax which is with the old Panamax beam and with a length of 230 meters is limited to 84,000 dwt type. For PCCs, NSY and Shin Kurushima Dockyard might be candidates. They are expected to focus on LNG fuel. As for the WET type, NSY, NAMURA SHIPBUILDING, NACKS, DACKS, Sumitomo Heavy Industries (AFRAMAX), Onomichi Dockyard (MR), Shin Kurushima and NAIKAI ZOSEN are also engaged in this business. Shin Kurushima and NAIKAI ZOSEN are the only major shipbuilders that produce chemical ships. In this way, the shipbuilding market in Japan can be sorted out.

It is obvious that Japanese shipyards are now competition in their financial strength, and they are forced to focus on building vessels at low prices relative to the market. On the other hand, in the near future, environmental measures will have to be put forward, and new designs applying such environmental issue will have to be developed after research and development with huge cost.

It might be enormous issue, Japanese shipbuilding companies provides the tools of logistics that support our lives and industries. Maritime logistics supports many industries in Japan so that we should call it as the essential industries. Indirectly, shipyards support Japanese industry. In considering environmental measures, I fear that Japanese industry itself will sink unless we move to a stage where society as a whole supports shipbuilding, rather than just asking shipbuilding companies to develop cheaper vessels with lower costs.

Yamamoto:I agree with you. I was impressed by what one president of a shipbuilding company said when I interviewed him. He said, "We have no choice however to build vessels in Chinese shipyards because of their low prices. However, after three or four years later, when we will realize that vessels built in Japan will have fewer troubles, lower operation costs and better quality in the long run, Japanese shipyards have possibility to disappear. This is because, for example, if a shipyard that used to build 10 ships a year reduces its capacity to five ships, the parts supplier of them will naturally have to raise their costs, otherwise they will not be able to hold on. He said that he wants people to understand that Japanese shipyards are essential function and facility for operators and ship owners.

Tanishige:I would like to plan future conversations on the themes of environmental measures and new technologies in shipbuilding. Thank you very much for your time today.

Yamamoto and Matsushita:Thank you very much.

To 3rd (PART 1)

To 3rd (PART 1)